Ask not what NAfME or your state MEA can do for you, but what YOU, a retiree, can do for your professional association and music education.

– An adaptation of the famous excerpt from the 35th U.S. President John F. Kennedy’s inaugural address of January 20, 1961.

Surfing the ‘Net, I found an appropriate acronym for R.E.T.I.R.E. by Tangled Tulip Designs in pinterest – Relax, Entertain, Travel, Indulge, Read and Enjoy! Most retirees would probably agree! The cessation of full-time employment may offer a great release from the day-to-day stress and drudgery of the job and the freedom to venture out, self-reinvent, make future goals, nurture relationships, and explore new personal growth opportunities.

Many attribute embracing a career in music education as “a calling” as opposed to just a form of employment or livelihood. From my experience, I have witnessed that most music educators are passionate for the cause of fostering creative self-expression in their students, more of a 24/7 mission, bringing intense focus and dedication to their lifework.

More to the point: Do we ever truly retire from making music ourselves and fostering this love in others?

THE “WHY!” Retirees matter and are critically needed!

One of my favorite inspirational speakers (Simon Sinek) would say, “start with the WHY!” WHY is this discussion on professional engagement of retired educators so important today?

- Their need: An informal poll of my former local educators and administrators revealed that half of them “hate retirement!” According to Dr. Robert P. Delamontagne in his book Retiring Mind (Fairview Imprints), “50% of retirees will suffer some form of acute emotional distress. This is potentially a very large problem given the fact that 10,000 people are becoming eligible for Social Security every day for the next 20 years in the US alone.” Remember this statistic the next time a senior citizen cuts you off on the road or bangs a shopping cart into your leg at the checkout!

- Our need: We are facing shortages of qualified teaching candidates across the country with unfilled openings in public school music positions and the critical need of training/mentoring the new hires.

- Society’s need: All of our voices should be combined to support the advocacy of music education, actively promoting access to school music by sharing its academic and social benefits with decision-makers, building relationships with administrators and policymakers, and utilizing resources from organizations like NAfME and the NAMM Foundation.

Despite its proven benefits, music education is often the first program to face budget cuts in schools. This is especially concerning in underserved communities, where access to music programs can be life-changing. Now more than ever, we must advocate for music education to ensure that every child has the opportunity to experience its benefits. Investing in music education is an investment in the future of our communities — helping to cultivate the next generation of creative, resilient, and innovative leaders.

– “Why Music Education Matters More Now Than Ever” by Music Will, February 2025

For eleven years (and counting), I serve as the Pennsylvania Music Educators Association (PMEA) Retired Member State Coordinator, as well as the Past State Chair (current member) of the PMEA Council for Teacher Training, Recruitment and Retention. I believe my responsibility to the state association is two-fold:

- Assist soon-to-retire professionals in achieving a smooth transition to a happy and satisfying retirement; to help them cope with the commonly-experienced emotional ups-and-downs of this life passage, wrestling with the question “what do you want to be or do when you grow up?” and making new life lesson plans and personal goals.

- Reach out to and build meaningful connections with retirees in order to fully engage them towards becoming active in their professional association; to recount, represent, and revitalize the activities of our post full-time employed music educators.

This article proposes a roadmap of crucial pathways to help music teachers approach “retirement bliss” while tapping into their hard-earned knowledge, strengths, and experiences by cultivating the benefits of their renewed participation in our professional associations.

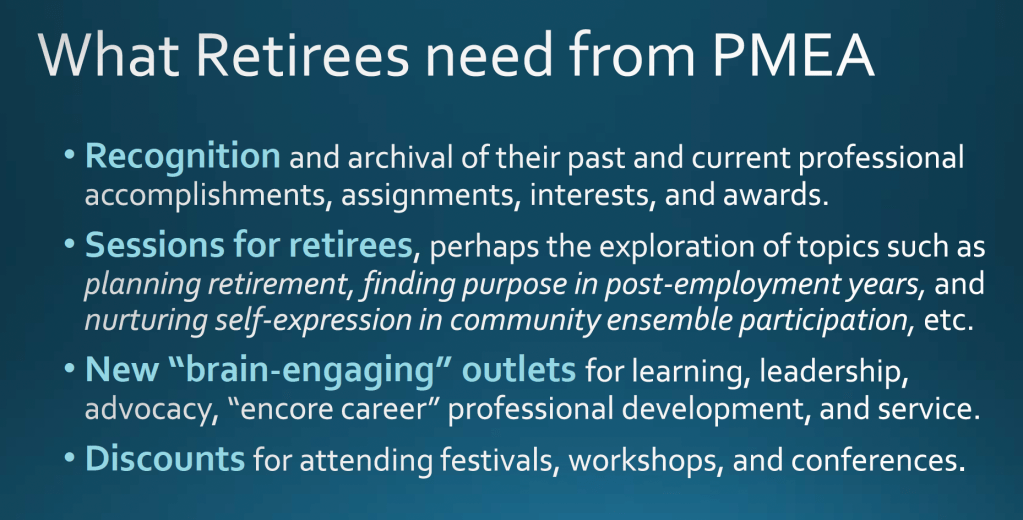

What can NAfME and State MEAs offer retirees?

You have devoted your entire life to inspiring the development of personal artistry and “ah-ha” musical moments in others. Now it is your turn to reap the benefits (and privileges) of this commitment to the profession. NAfME and your MEAs can provide the resources and motivation of “sharing and caring,” directing retirees “places to go, people to meet, and things to do” for fulfilling that “next chapter” or (perhaps better terms) the “refirement” or “rewirement” of senior living.

Do you feel “needed” and know you “make a difference?” Research has shown that the one of the most important motivators for involvement in a professional association is that its members recognize that they are essential to its success. This quote is from Revitalizing Retirement: Reshaping Your Identity, Relationships, and Purpose by Nancy Schlossberg, attributed to Rosenberg/McCullough:

“It has been suggested that one problem of retirement is that one no longer matters; others no longer depend on us… The reward of retirement, involving a surcease from labor, can be the punishment of not mattering. Existence loses its point and savor when one no longer makes a difference.”

Most people who are one to five years away from “pulling their pin” and putting in their walking papers “do not know what they do not know.” Experts agree: “Retirement preparation is not only about the money!” Our silver-haired colleagues who have already Crossed the Rubicon and are now “living the dream” in retirement can share their trials, tribulations, and (more importantly) numerous success stories about coping with this transition!

NAfME, PMEA and this paulfox.blog/for-retirees site have archived an exhaustive number of self-help articles. Check out this omnibus NAfME blog “Retirement Prep Top-Ten Treasures.”

The benefits of retired MEA membership are numerous. Besides providing helpful transitioning advice, these advantages also come to mind:

- Answers to questions like “What have you always wanted to sing, compose, play, record, conduct, write, publish or present?” and “Where can I share my hard-won expertise and help others in the field?”

- Networks and contacts to help you develop “encore careers” in other musical or educational arenas (e.g., higher education, music industry, festival organization, travel/tour planning, composition, guest conducting, private studio teaching, church music, etc.)

- Opportunities to “rekindle your expressiveness” by participation in adult community or full/part time performance groups (playing “gigs”)

- Places to go/things to see/hear: NAfME/MEA conferences, workshops, and concerts

- Exclusive discounts and other benefits (reduced dues and registration fees)

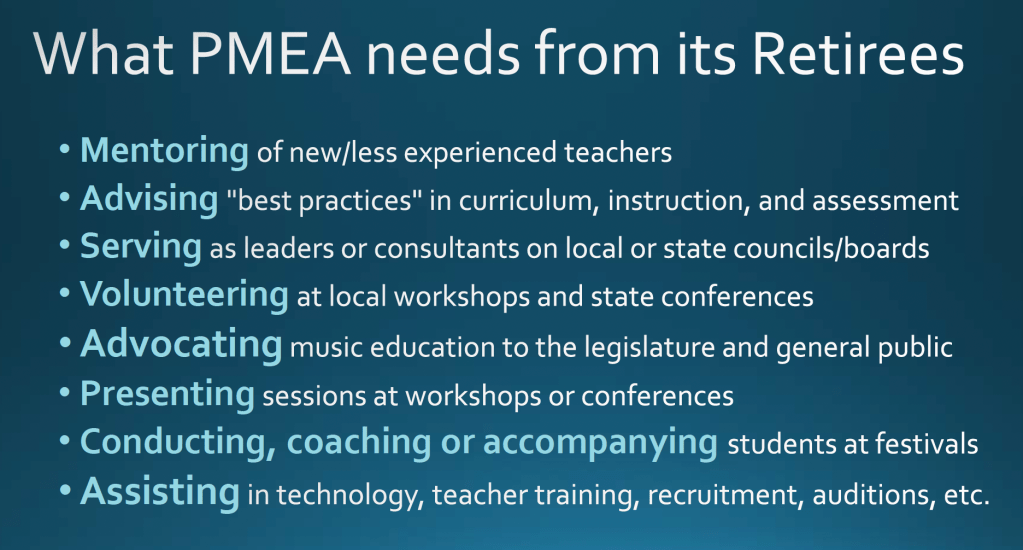

What can retirees offer NAfME and their state MEA?

The relationship of active and retired membership in our MEAs is symbiotic. We know from the history of our associations, “giving back to the profession” remains a high priority with most retirees. This may come in many forms and settings:

- Leadership or membership in local, state, or national MEA/NAfME office, staff, advisor, or council/committee position

- Advocates for the promotion of music education to local and state government officials

- Service as presiding chair or member of the conference or workshop planning committee

- Service as evaluator of performance groups, conference sessions, or articles for publication

- Judges of local/state MEA adjudication or commercial festival

- Accompanists, coaches, arrangers, or guest conductors for festivals or school/community groups

- Services to the local music teacher in private teaching, piano playing, marching band charting, sectional coaching, choreography, music technology, instrumental repair, stage tech, etc.

- Writers for state MEA and NAfME publications and blog sites

- Contributors to online music education forums or the NAfME Connections

- Donors to and/or fund-raisers of music education charitable projects, scholarship initiatives, etc.

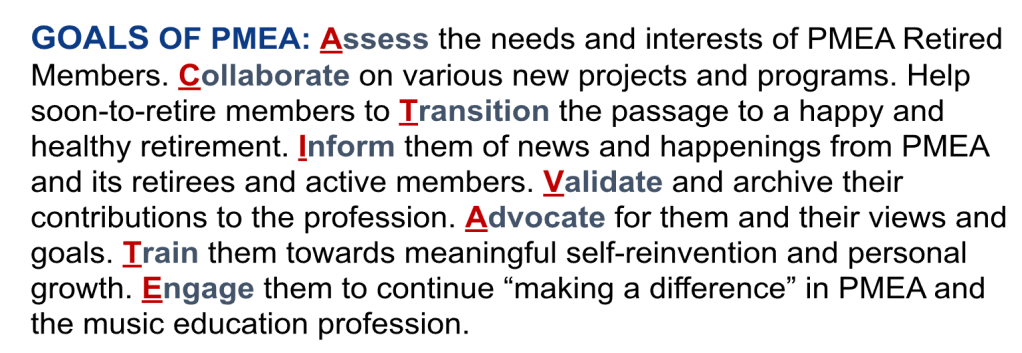

The PMEA Model of Retired Member Participation

PMEA values the vast wealth of experience and contributions of our retired members. We’re proud of the many programs we offer to retirees and invite you to visit our website to peruse additional information and sample digital newsletters and articles.

Retired members in Pennsylvania are involved in:

- PMEA elected and appointed offices, staff, committee chairs, and membership on councils

- PMEA Strategic Plan and Bylaws, Conference Planning, and other state/regional committees

- Retired Resource Registry* (informal mentoring for new teachers and transfers)

- How-to-Retire Webinar, Prepping for Retirement, and the Ultimate Retiree Resource Guide

- Retired Member Breakfast at PMEA Annual Conference

- Retirement 101 (The Who, What, When, Where, Why, and How) session at PMEA Annual Conference (training for all members retiring or soon-to-retire)

- Maintenance of PA Community Band, Chorus, Orchestra, and Theater group catalogs

- Maintenance of PMEA member compositions library

- Mock Job Interview Committee for music education majors

- Coffee & Conversations informal “ask an expert” lounge at PMEA Annual Conference

- Volunteering as presiding chairs for sessions and registration aides at conferences/workshops

- Pool of conference clinicians, guest lecturers, and members on discussion panels

- Participation in “Sponsor a Collegiate to Attend the Conference” campaigns

- All-State Program Patron, or contributor to the annual Irene Christman Scholarship or Margaret Bauer Grant programs.

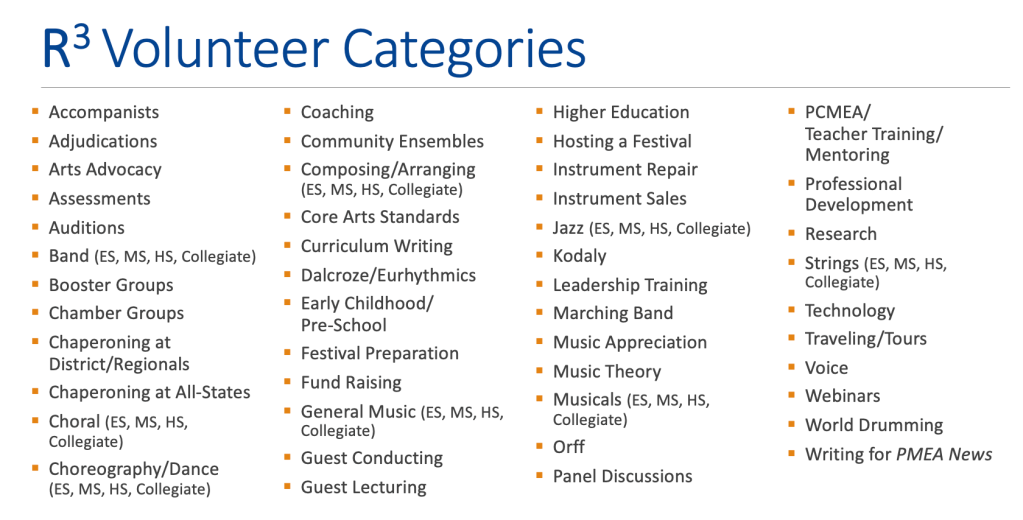

*During their annual membership registration, PMEA Retired Members may choose to sign-up for the R3 Retired Member Registry (above volunteer categories) to become available to informally offer advice to college music education majors, new hires, transfers, and newcomers to any music specialty. R3 members may handle inquiries like “What warm-up would you recommend for my middle school choir?” OR “Do you have an idea for an elementary string ensemble concert opener?” OR “How do you teach improvisation… steady beat… breath support?”

The other option with more time commitment is that Retired Members can be officially “trained” as a PMEA Mentor and be assigned to specific individuals who request assistance in their early career assignments.

Coda

How can we help?

What is the future of retired music educator professional engagement? In a word: connections!

Last month, I reached out to Elizabeth Welsh Lasko, NAfME Assistant Executive Director for Membership, Organizational Development, and Marketing Communications and “volunteered” OUR assistance. I suggested that, in keeping with the NAfME 2022 Vision Statement – “…an association where all people are heard, seen, and feel they belong throughout their lifelong experiences in music” – we should all intentionally recruit more hands-on involvement of our retirees. I pointed out that in the late 1980s, we had a Music Educators National Conference (MENC) Committee for Retired Members led by a National Chairman who served on the NAfME National Assembly. (An excellent booklet, TIPS: Retirement for Music Educators, Copyright © 1989 MENC, was compiled by A. Verne Wilson, then the Past National Chairman of the MENC Committee for Retired Music Educators.)

Ms. Lasko encouraged me to “reach out to retirees” beginning with this article. At the next NAfME Eastern Division Conference, I plan to hold a meeting of retired members, and also connect with all state MEA retired member coordinators (those states who have them). We’re available and on the move! Let’s collaborate and share our resources!

Finally, just for fun, I recently posted the blog “For Book Lovers – Retired or Not” on NAfME Connections (formerly called Amplify). There are already 1,810 members in the NAfME “Retired Members Community.” Please JOIN US! Using this forum, get in touch with me, and respond with YOUR OWN retirement stories, strategies, perspectives on this “life passage,” and more ideas to grow the professional engagement of our music teacher retirees.

Happy trails!

© 2025 Paul K. Fox

The “new” definition of retirement includes a unique collection of synonyms. Gone are the designations “seclusion,” “privacy,” “withdrawal,” “retreating” and “disappearing” based on archaic models of retiring when the average life expectancy at birth in the 1800s was 38 and in the 1900s was 47. (Merriam-Webster and others still show these words on their online dictionaries!) Now, some of the more creative descriptors for retirement are “renewment,” “rewirement,” “rest-of-life,” “second beginnings,” and “reinvention.”

The “new” definition of retirement includes a unique collection of synonyms. Gone are the designations “seclusion,” “privacy,” “withdrawal,” “retreating” and “disappearing” based on archaic models of retiring when the average life expectancy at birth in the 1800s was 38 and in the 1900s was 47. (Merriam-Webster and others still show these words on their online dictionaries!) Now, some of the more creative descriptors for retirement are “renewment,” “rewirement,” “rest-of-life,” “second beginnings,” and “reinvention.”

Feeling you were “kicked to the curb,” “downsized,” “minimized,” or somehow “forced” to resign or retire comes from many scenarios:

Feeling you were “kicked to the curb,” “downsized,” “minimized,” or somehow “forced” to resign or retire comes from many scenarios:

In retirement, this can be frustrating. You can’t tell somebody else how to run their operation. Some people do not want to hear criticism, nor do they care what your opinion is, nor do they want to change their traditions or fine-tuned (?) step-by-step procedures. You on the other hand want things to improve, e.g. better training, more consistent application of the rules, etc., and therefore you feel “unrequited stress.”

In retirement, this can be frustrating. You can’t tell somebody else how to run their operation. Some people do not want to hear criticism, nor do they care what your opinion is, nor do they want to change their traditions or fine-tuned (?) step-by-step procedures. You on the other hand want things to improve, e.g. better training, more consistent application of the rules, etc., and therefore you feel “unrequited stress.”

However, invest your time wisely. Retirees deserve a life of their own and opportunities for unstructured “time-off.” Don’t forget the other items on your “bucket lists” (like travel, “encore career,” and volunteering). Serving as your family’s childcare “safety net” is nice, but don’t let this schedule dominate everything you do in your retirement… trading one job for another… with no financial compensation (but a whole lot of fun, I know).

However, invest your time wisely. Retirees deserve a life of their own and opportunities for unstructured “time-off.” Don’t forget the other items on your “bucket lists” (like travel, “encore career,” and volunteering). Serving as your family’s childcare “safety net” is nice, but don’t let this schedule dominate everything you do in your retirement… trading one job for another… with no financial compensation (but a whole lot of fun, I know). Again, that focus on “first things first” (remember the book of the same name by Stephen Covey?) and “take care of yourself, too!”

Again, that focus on “first things first” (remember the book of the same name by Stephen Covey?) and “take care of yourself, too!”

PSERS (PA pension fund) Planning: 12 months or more away from your projected retirement date, attend a “Foundations for Your Future” program (even attend it more than once), and request a retirement estimate (form PSRS-151), after which you will need to schedule the all-important “Exit Counseling Session.”

PSERS (PA pension fund) Planning: 12 months or more away from your projected retirement date, attend a “Foundations for Your Future” program (even attend it more than once), and request a retirement estimate (form PSRS-151), after which you will need to schedule the all-important “Exit Counseling Session.”