Dispelling Five Common Misconceptions Involving One of Life’s Greatest Transitions – Perspectives from Gerontologists, Psychologists, Authors, and Other “Retiree Gurus”

Throughout my travels presenting at music educator conferences and local workshops, I discover soon-to-retire music teachers and other professionals have many preconceived notions about retirement. I hear the general acceptance of many “myths,” including these five  that seem to be the most prevalent:

that seem to be the most prevalent:

- You retire FROM something.

- It’s an easy transition.

- It takes little time to prepare.

- It’s completely different from anything you’re doing now.

- Retirement is the time to downsize and move.

Let’s “troll the Internet” a little and check-in with a few leading authorities on retirement planning.

You should retire to, not from, something.

“Most people today view retirement as an opportunity to begin a new chapter in their lives, ‘not a time to wind down and move off the playing field,’ says gerontologist Ken Dychtwald, 64, the CEO of Age Wave, a research think-tank on aging issues.”

“They are trying to figure out new ways to be productive. ‘Many are wondering: What can I do with this stage of my life that is perhaps my highest purpose?’ says Dychtwald, who is also a psychologist. He has written 16 books on aging, health, and retirement issues.”

— “How to Reinvent Yourself in Retirement” by Nanci Hellmich, USA TODAY: https://www.usatoday.com/story/money/personalfinance/2014/10/12/five-stages-of-retirement/16975707/

“You really should retire to something, not just retire from something… Having a notion of what you are retiring to is also a necessary early retirement planning activity. One that everyone should complete.”

“I would say that I just want the freedom to do whatever I want to do. To spend time in the garden, exercise, travel, pursue opportunities that interested me, learn new things, meet new people, etc. I had done the necessary steps of making sure that I had budgeted for my hobbies and our travel wishes. I thought that was enough. However that wasn’t going to occupy all of my retirement days.”

“Now I do want and enjoy free time where there are no obligations just as much as the next guy, but I needed to look at what I was really retiring to so I wouldn’t end up one of those unfortunate retirees who say they are bored and wished they had never retired. That is why you should plan to retire to something, not just retire from something.”

— “Retire To Something,” Leisure Freak Tommy: https://www.leisurefreak.com/non-financial-aspects-of-early-retirement/retire-to-something/

“Throughout your working years, you have probably viewed your retirement as a destination. It is a goal you are saving for and will hopefully reach one day. But once you reach this destination, then what? ”

“The perception of retirement as a destination may be why some people approach retirement with dread rather than anticipation. They view retirement as a finish line or as the end of the road.”

“But retirement is simply a milestone you pass on your journey. It’s like crossing the border from one state to the next. The road will continue to unfold before you.”

“Your life has changed in countless ways from the time you graduated from school and entered the full-time work force until the present. You have probably changed jobs and perhaps changed careers. You may have lived in numerous places, gotten married and raised a family. Friends have come and gone, your hobbies and interests have evolved and your body has changed.”

“Your retirement could easily last two or three decades. It won’t be a one-dimensional, stagnant state of being. Your life will continue to evolve in many ways after you retire. You may move, the people in your life will continue to shift and you will probably travel to new places and engage in new activities.”

— “Your Retirement is a Journey, Not a Destination” by Dave Hughes, RetireFabulously: http://retirefabulously.com/2017/05/15/your-retirement-is-a-journey-not-a-destination/

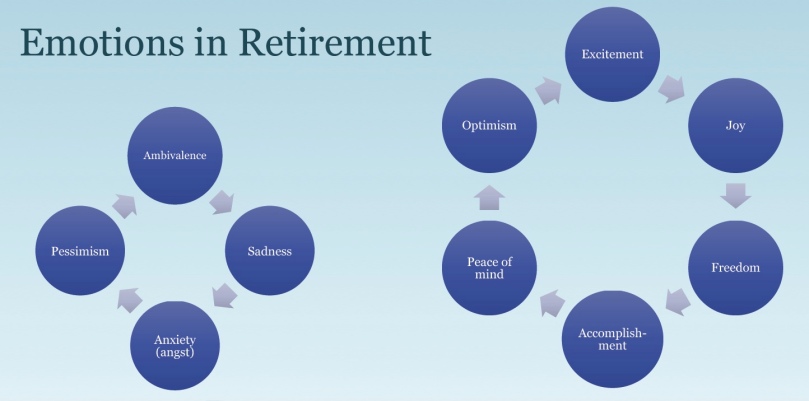

For many, retirement may not be an easy transition.

“50% of retirees will suffer some form of acute emotional distress. This is potentially a very large problem given the fact that 10,000 people are becoming eligible for Social Security every day for the next 20 years in the US alone.”

— Dr. Robert P. Delamontagne in Retiring Mind, Fairview Imprints, 2010: http://www.theretiringmind.com/

“For some people, retirement planning conjures up images of languid days free from the demands of the daily grind, but for others the prospect of leaving the workforce may be a daunting or even frightening transition.”

“For most, this major milestone will elicit a mixture of emotions that fall somewhere between anticipation and apprehension. Retirement is, in fact, a complex experience for almost everyone, characterized by gains and losses and tremendous shifts in identity and routines.”

“Unless those challenges are addressed and dealt with, the so-called ‘golden years’ can be tarnished,” says Irene Deitch, PhD, psychologist and professor emeritus at the College of Staten Island, City University of New York. “Even those who may have thought they were prepared can find that the transition is tougher once they’re actually in the throes of it.”

—”Eight Ways to Ease into Retirement” by Katherine Lee, Everyday Health: https://www.everydayhealth.com/longevity/future-planning/happy-retirement.aspx

Preparation to retirement is essential for you and your family members.

“Most gerontologists agree that a period of adjustment will occur during the first years of “interning” as a retiree. Even more crucial is the “pre-retirement” or “imagination” stage of retirement, involving your preparation six to ten years prior to “taking the big leap” to FREEDOM!”

“Have you considered a few ‘terms of transformation’ below that are all-to-common to soon-to-be-retirees undergoing that life-changing transition to ‘living their dream?’ How should you unravel these “conundrums” or mysteries of transitioning to retirement?

- Self-Identity and Change

- Free Time

- Energy and Fortitude

- Losing Control and Perpetual Care”

“The only solution to ‘softening the blow’ of the possible turmoil and incongruity brought on at this time is to follow the Boy Scout rule… BE PREPARED.”

“According to TIPS Retirement for Music Educators by Verne A. Wilson (MENC 1989), at least three years before you leave your full-time employment:

- Sit down with your spouse if you are married (and other family members) and plan ahead carefully.

- Decide when you want to retire. Estimate as accurately as possible what your economic situation will be after you retire.

- Decide where you want to live after you retire. This means not just the neighborhood, city, or state, but also the kind and style of residence… retirement community, one-floor ranch, apartment, etc.

- Set some goals regarding how you want to spend your retirement time. Focus on your talents and abilities instead of looking at the handicaps that may come with the aging process.

- Be prepared for “change” and learn how to accept it, and be willing to embrace new opportunities for personal growth, flexibility, and adaptability.

- Be sure your intentions are clearly stated in writing (wills, power of attorneys, living wills, etc.)”

— “New Dreams and Horizons” by Paul K. Fox and other sources: https://paulkfoxusc.wordpress.com/2017/08/03/new-dreams-and-horizons/

“Prior to retiring, you should make a concerted effort to prepare for ‘life after work,’ including:

- Cultivate interests outside work

- Lead a healthier lifestyle

- Revitalize family relationships

- Spend more time with spouse

- Embrace spirituality or meditation

- Nurture friendships and make new friends”

— “Retire Happy: What You Can Do Now to Guarantee a Great Retirement” by Richard Stim and Ralph Warner, USA TODAY/Nolo Series: https://www.amazon.com/dp/141330835X/ref=rdr_ext_tmb

Retirement may or may not be completely different to what you are doing right now.

“Many people want to continue to work. In fact, 72% of pre-retirees, age 50 and older, say they want to keep working after they retire, according to a recent survey sponsored by Merrill Lynch in partnership with Age Wave. Almost half (47%) of current retirees either are working, have worked, or plan to work in retirement, the survey found.”

— “Work in Retirement: Myths and Motivations,” by Merrill Lynch in partnership with Agewave: https://agewave.com/wp-content/uploads/2016/07/2014-ML-AW-Work-in-Retirement_Myths-and-Motivations.pdf

“Planning for retirement may require a focus on self-management throughout a person’s career, according to a model of career development by psychologist Harvey Sterns, PhD, the director of the Institute for Life-Span Development and Gerontology at the University of Akron.

“No two retirees are the same and multiple pathways exist to get from work to retirement.”

“There is no right way to retire,” Sterns says. “Many people think retirement is wonderful, and for people who want to retire, that’s the right thing to do. If they don’t want to, that’s the right thing, too.”

“After 26 years as a counseling psychology professor at the University of Maryland, Nancy K. Schlossberg, EdD, was ready to retire. But she was hardly ready to slow down. She looked forward to having more flexibility and freedom in her schedule to explore other interests. Still, there was the question of what her new identity would be…”

“Retirement can take many forms, Schlossberg notes. In fact, she identified the following six based on her interviews with about 100 retirees:

- Continuers stay connected with past skills and activities, but modify them to fit retirement, such as through volunteering or part-time work in their former field.

- Adventurers start new activities or learn new skills not related to their past work, such as learning to play the piano or taking on an entirely new job.

- Searchers learn by trial and error as they look for a niche; they have yet to find their identity in retirement.

- Easy gliders enjoy unscheduled time and like their daily schedule “to go with the flow.”

- Involved spectators maintain an interest in their previous field of work but assume different roles, such as a lobbyist who becomes a news junkie.

- Retreaters become depressed, retreat from life and give up on finding a new path–the only negative path in Schlossberg’s classification.”

“The path retirees choose after retirement isn’t necessarily the path they stay on either, Schlossberg says.”

“It’s an evolving part of your career development,” Schlossberg explains. “And the longer you live, the more your path will shift and change.”

— “A New Face to Retirement” by Melissa Dittman, American Psychological Association: http://www.apa.org/monitor/nov04/retirement.aspx

“After the last school bell rings, retired teachers have a leg up. Opportunities cut a broad swath from tutoring to substitute teaching to jobs a little further afield, such as fitness training.”

“Teachers have a combination of tools in their kit that many retirees don’t — solid degree credentials, expertise in a specific field and a passion for helping people learn something new.”

— “Great Jobs for Retired Teachers” by Kerry Hannon, AARP: https://www.aarp.org/work/working-after-retirement/info-04-2011/jobs-for-retired-teachers.1.html

“Most teachers spend their first year of “retirement” decompressing from the full-time teaching gig. It’s that special time you’ve looked forward to for years. You do some traveling, catch up on all those books you never had time to read, and just relax. Your days are free of ringing bells and reports. Plus, you get to spend a much larger part of your day in your pajamas. Yay! You earned it. You know you’ve arrived when Labor Day stops feeling like D-Day.”

“After a year or so, however, you may start to realize you actually miss working. Not that you miss the standardized tests, parent conferences and grade reports. But something in that work stimulated you in a way nothing else comes close to doing. Perhaps you miss the pleasure you felt creating learning units, or the joy of introducing students to a new author, or the collaborative bonds with fellow teachers. These were true enjoyments and now they are gone.”

“Once you’ve decompressed sufficiently, you might want to consider doing a career redesign. Unlike many other careerists, retired teachers have the freedom and the financial ability to put together a ‘second-act’ career, tailored to the life they want. Keep in mind, U.S. pension policies have restrictions on post-retirement income, so keep a close check on those caps.”

“If you’re feeling ready to begin again, here are ten opportunities you should definitely consider.

- Tutoring

- Specialized Test Prep

- College Application Support

- College Adjunct Teaching

- Career and Life Coach

- Tour Guide

- Writing and Editing

- Educational Consulting

- Translator

- International Schools”

— “Ten Great Encore Careers for Retired Teachers” by Peter Spellman, Nextcalling: https://nextcalling.org/wp-content/uploads/2018/01/10-Great-%E2%80%98Encore-Careers%E2%80%99-for-Retired-Teachers.pdf

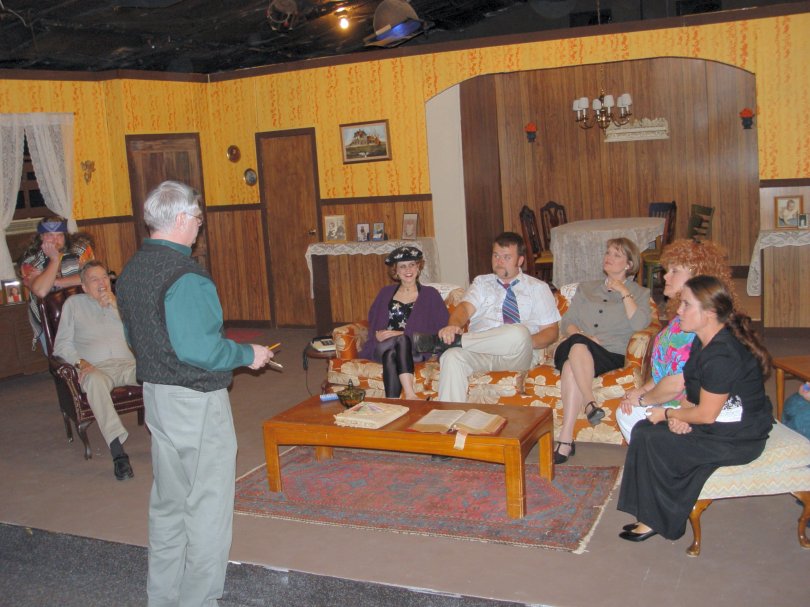

“We were fortunate to have Dr. John V. D’Ascenzo join the PMEA Retired Member Coordinator at the PMEA Summer Conference, assisting on the session “Retirement 101 – Retiree Stories and Strategies,” which was held on July 17-18, 2018 at the Red Lion Hotel in Harrisburg, PA.”

“John provided a lot of interesting perceptions and coping tips for the “soon-to-retire!” He shared new segments for consideration with references.”

“The evaluating of personal and professional paths prior to and at the time of retirement leads to behavioral changes that promote positive outcomes (Krawulski, de Oliviera Cruz, Medina, Boehs & de Toledo, 2017). Activities would include:

- Giving and/or receiving education/training.

- Volunteering roles: leadership, followership

- Pursue different career paths for remuneration or gratis.”

Retired Member Network eNEWS, August 2, 2018: https://www.pmea.net/wp-content/uploads/2018/07/Retired-Member-Network-eNEWS-080218.pdf

Retirement may or may not be the time to pull-up stakes and move from your current residence.

“The US Census Bureau reports that 49 out of 50 people over the age of 65 stay right where they are when they retire.”

“If your current hometown is affordable, close to friends and family, and near activities and entertainment you most enjoy, why move for the sake of moving? Instead, consider whether the need for change can be satisfied through more frequent brief vacations, or by purchasing an inexpensive weekend getaway home.”

— “Fine Out Where You Should Retire” by Melissa Phipps, The Balance: https://www.thebalance.com/where-should-i-retire-2894254

My next blog for this “Retirement Resources” forum will investigate this subject more closely and pose the questions, “Where Should I Retire?” and “What are the three most important factors to consider before choosing your retirement destination?”

Retirees: Do you have YOUR favorite “myth in retirement?” Please share. (Click on “comment” near the top of this article.) We would love to hear from you!

Otherwise, stay tuned for additional thoughts and tips on preparing a happy transition to retirement. You are also invited to revisit past blog-posts at this site: https://paulkfoxusc.wordpress.com/for-retirees/.

PKF

© 2018 Paul K. Fox

Photo credits (in order) from Pixabay.com: “emotional” by werner22brigitte, “knit” by foundry, “grandma” by fujidreams,”senior” by RitaE, “fisherman” by paulbr75, “old couple” by MonicaVolpin, “trumpet-player” by Hans, “fashion” by skeeze, “violin” by niekverlaan, “artist” by imaginart, “guitarist” by SplitShire, and “cottage” by MonikaDesigns.

The music parents are another matter. I had great support of both the band/string parents and my loyal “theater angels” throughout my career, and I made sure to attend meetings as early as possible to tell them “in person” my future plans so that they did not have to rely on those “rumors on the street!” One advantage I had was I lived in the district. I promised to roll-up my sleeves and support a fund-raiser or two, and was able to attend numerous concerts and musicals to support my “extended family” as a nonjudgmental retiree.

The music parents are another matter. I had great support of both the band/string parents and my loyal “theater angels” throughout my career, and I made sure to attend meetings as early as possible to tell them “in person” my future plans so that they did not have to rely on those “rumors on the street!” One advantage I had was I lived in the district. I promised to roll-up my sleeves and support a fund-raiser or two, and was able to attend numerous concerts and musicals to support my “extended family” as a nonjudgmental retiree.

In Pennsylvania, we are fortunate to have the

In Pennsylvania, we are fortunate to have the

The “new” definition of retirement includes a unique collection of synonyms. Gone are the designations “seclusion,” “privacy,” “withdrawal,” “retreating” and “disappearing” based on archaic models of retiring when the average life expectancy at birth in the 1800s was 38 and in the 1900s was 47. (Merriam-Webster and others still show these words on their online dictionaries!) Now, some of the more creative descriptors for retirement are “renewment,” “rewirement,” “rest-of-life,” “second beginnings,” and “reinvention.”

The “new” definition of retirement includes a unique collection of synonyms. Gone are the designations “seclusion,” “privacy,” “withdrawal,” “retreating” and “disappearing” based on archaic models of retiring when the average life expectancy at birth in the 1800s was 38 and in the 1900s was 47. (Merriam-Webster and others still show these words on their online dictionaries!) Now, some of the more creative descriptors for retirement are “renewment,” “rewirement,” “rest-of-life,” “second beginnings,” and “reinvention.”

Feeling you were “kicked to the curb,” “downsized,” “minimized,” or somehow “forced” to resign or retire comes from many scenarios:

Feeling you were “kicked to the curb,” “downsized,” “minimized,” or somehow “forced” to resign or retire comes from many scenarios:

In retirement, this can be frustrating. You can’t tell somebody else how to run their operation. Some people do not want to hear criticism, nor do they care what your opinion is, nor do they want to change their traditions or fine-tuned (?) step-by-step procedures. You on the other hand want things to improve, e.g. better training, more consistent application of the rules, etc., and therefore you feel “unrequited stress.”

In retirement, this can be frustrating. You can’t tell somebody else how to run their operation. Some people do not want to hear criticism, nor do they care what your opinion is, nor do they want to change their traditions or fine-tuned (?) step-by-step procedures. You on the other hand want things to improve, e.g. better training, more consistent application of the rules, etc., and therefore you feel “unrequited stress.”

However, invest your time wisely. Retirees deserve a life of their own and opportunities for unstructured “time-off.” Don’t forget the other items on your “bucket lists” (like travel, “encore career,” and volunteering). Serving as your family’s childcare “safety net” is nice, but don’t let this schedule dominate everything you do in your retirement… trading one job for another… with no financial compensation (but a whole lot of fun, I know).

However, invest your time wisely. Retirees deserve a life of their own and opportunities for unstructured “time-off.” Don’t forget the other items on your “bucket lists” (like travel, “encore career,” and volunteering). Serving as your family’s childcare “safety net” is nice, but don’t let this schedule dominate everything you do in your retirement… trading one job for another… with no financial compensation (but a whole lot of fun, I know). Again, that focus on “first things first” (remember the book of the same name by Stephen Covey?) and “take care of yourself, too!”

Again, that focus on “first things first” (remember the book of the same name by Stephen Covey?) and “take care of yourself, too!”

PSERS (PA pension fund) Planning: 12 months or more away from your projected retirement date, attend a “Foundations for Your Future” program (even attend it more than once), and request a retirement estimate (form PSRS-151), after which you will need to schedule the all-important “Exit Counseling Session.”

PSERS (PA pension fund) Planning: 12 months or more away from your projected retirement date, attend a “Foundations for Your Future” program (even attend it more than once), and request a retirement estimate (form PSRS-151), after which you will need to schedule the all-important “Exit Counseling Session.”

That means, according to TIPS Retirement for Music Educators by Verne A. Wilson (MENC 1989), at least three years before you leave your full-time employment:

That means, according to TIPS Retirement for Music Educators by Verne A. Wilson (MENC 1989), at least three years before you leave your full-time employment: Robert Delamontagne writes in detail about using the

Robert Delamontagne writes in detail about using the  Delamontagne labels the characteristics of each E-Type. After reading his book, which ones are closest to resembling you and your spouse?

Delamontagne labels the characteristics of each E-Type. After reading his book, which ones are closest to resembling you and your spouse? On their book jacket, Duckworth and Langworthy promote their work as “a call to action on your own behalf” to:

On their book jacket, Duckworth and Langworthy promote their work as “a call to action on your own behalf” to: Life Themes Profiler, a comprehensive assessment tool developed by David Borchard and laid out initially in Chapter 4, will help you understand and graph the retirement themes and “your intentions for the next chapter of your life.”

Life Themes Profiler, a comprehensive assessment tool developed by David Borchard and laid out initially in Chapter 4, will help you understand and graph the retirement themes and “your intentions for the next chapter of your life.” Obviously, fulfilling your “bucket lists” and goals will influence the structure of your daily/weekly schedule. According to Ernie Zelinski, with or without “a job,” you need to find a “work-life balance” and devote equal time to these essential priorities:

Obviously, fulfilling your “bucket lists” and goals will influence the structure of your daily/weekly schedule. According to Ernie Zelinski, with or without “a job,” you need to find a “work-life balance” and devote equal time to these essential priorities: Dave Hughes echoes these sentiments with his “four essential ingredients for a balanced life” in the book Design Your Dream Retirement: How to Envision, Plan for, and Enjoy the Best Retirement Possible (2015):

Dave Hughes echoes these sentiments with his “four essential ingredients for a balanced life” in the book Design Your Dream Retirement: How to Envision, Plan for, and Enjoy the Best Retirement Possible (2015): Do something every day that will expand your mind, stimulate your intellect, or increase your curiosity quotient.

Do something every day that will expand your mind, stimulate your intellect, or increase your curiosity quotient. Although the exact number of boomers and seniors who experience sleep problems is hard to pinpoint, a national study of our aging population suggests nearly 42 percent of those surveyed have sleep difficulties. That figure is beyond an epidemic.

Although the exact number of boomers and seniors who experience sleep problems is hard to pinpoint, a national study of our aging population suggests nearly 42 percent of those surveyed have sleep difficulties. That figure is beyond an epidemic. Regular physical activity is a must. Quoting from a future article I plan to submit to the state journal of Pennsylvania Music Educators Association PMEA News: “The definition of ‘exercise,’ especially in order to receive cardiovascular benefits, is to raise your heart rate for 30 minutes or more. Leaving your La-Z-Boy to let the dogs out or looking for the remote does not count!”

Regular physical activity is a must. Quoting from a future article I plan to submit to the state journal of Pennsylvania Music Educators Association PMEA News: “The definition of ‘exercise,’ especially in order to receive cardiovascular benefits, is to raise your heart rate for 30 minutes or more. Leaving your La-Z-Boy to let the dogs out or looking for the remote does not count!” This final category of “pre-retirement planning” has everything to do with living with independence and security as we grow older. Many Baby Boomers just starting their retirement journey may not actually see this as “a big deal” right now. However, developing a long term “backup plan” for maintaining our health care, mobility, and comfortable living is critical. Again… we must think ahead!

This final category of “pre-retirement planning” has everything to do with living with independence and security as we grow older. Many Baby Boomers just starting their retirement journey may not actually see this as “a big deal” right now. However, developing a long term “backup plan” for maintaining our health care, mobility, and comfortable living is critical. Again… we must think ahead! Fifty-five percent of our respondents wanted to stay in their own homes, with help as needed, as they got older and required more care. But a recent AARP survey revealed that only about half of older adults thought their homes could accommodate them “very well” as they age; twelve percent said “not well” or “not well at all.”

Fifty-five percent of our respondents wanted to stay in their own homes, with help as needed, as they got older and required more care. But a recent AARP survey revealed that only about half of older adults thought their homes could accommodate them “very well” as they age; twelve percent said “not well” or “not well at all.”

Reprinted from the Winter 2016 PMEA News, the state journal of the Pennsylvania Music Educators Association.

Reprinted from the Winter 2016 PMEA News, the state journal of the Pennsylvania Music Educators Association. “Dogs in particular can reduce stress, anxiety, and depression, ease loneliness, encourage exercise and playfulness, and even improve your cardiovascular health.”

“Dogs in particular can reduce stress, anxiety, and depression, ease loneliness, encourage exercise and playfulness, and even improve your cardiovascular health.” Once you reach full retirement, you may find yourself with a lot more “freedom” and time “at-home” to share with your spouse, other loved ones (babysitting grandchildren/ nieces?), friends, personal music-making, hobbies, and pets! Indeed, this may be the first chance you have to go out and rescue a dog from an animal shelter. Full-time music teachers with those incredibly packed schedules of after-school/evening marching band practices, choir, band, orchestra, jazz, musical, and/or dance rehearsals and performances, their own concert gigs, private lessons, etc. may not be able to properly care for a dog by themselves. The only reservation to bringing a new dog into your home is if you plan to take a lot of long trips in retirement. Perhaps then, you can revisit the option of animal adoption after taking several cruises, safaris, and cross-country road trips. Pets need your love and attention!

Once you reach full retirement, you may find yourself with a lot more “freedom” and time “at-home” to share with your spouse, other loved ones (babysitting grandchildren/ nieces?), friends, personal music-making, hobbies, and pets! Indeed, this may be the first chance you have to go out and rescue a dog from an animal shelter. Full-time music teachers with those incredibly packed schedules of after-school/evening marching band practices, choir, band, orchestra, jazz, musical, and/or dance rehearsals and performances, their own concert gigs, private lessons, etc. may not be able to properly care for a dog by themselves. The only reservation to bringing a new dog into your home is if you plan to take a lot of long trips in retirement. Perhaps then, you can revisit the option of animal adoption after taking several cruises, safaris, and cross-country road trips. Pets need your love and attention!

Several of my own experiences “learning and growing” with Brewster (a yorkie-poo) and Gracie (a bichon frise), “new children” added to my household immediately after retirement, are shared at

Several of my own experiences “learning and growing” with Brewster (a yorkie-poo) and Gracie (a bichon frise), “new children” added to my household immediately after retirement, are shared at  So f

So f or what are you waiting? Go out and find a dog or cat to rescue… or at least pet one! You’ll be glad you did!

or what are you waiting? Go out and find a dog or cat to rescue… or at least pet one! You’ll be glad you did!

is the most essential “tech tool” to maintain your “now busier than ever” daily/weekly plan.

is the most essential “tech tool” to maintain your “now busier than ever” daily/weekly plan. r as changing my passwords. Everyone knows, with hackers lurking around every corner of the Internet, you are supposed to do two things: have a different password for each application, and from time to time, change these passwords. They should not be something someone else could guess, like “1234” or your phone number or the nickname “foxy” for me. A “good” password should utilize numbers, capitalized letters and small-case, and special characters like $, &, or underline. Using a password manager program like

r as changing my passwords. Everyone knows, with hackers lurking around every corner of the Internet, you are supposed to do two things: have a different password for each application, and from time to time, change these passwords. They should not be something someone else could guess, like “1234” or your phone number or the nickname “foxy” for me. A “good” password should utilize numbers, capitalized letters and small-case, and special characters like $, &, or underline. Using a password manager program like  Girls three-part movie or The Crown (Netflix), all I have to do is go into another room, fire up my computer’s browser, and check out the latest video podcast of

Girls three-part movie or The Crown (Netflix), all I have to do is go into another room, fire up my computer’s browser, and check out the latest video podcast of  One of my hobbies furthest from a career in music education has to do with collecting and reading books about World War II, particularly U.S. Navy, submarines and surface fleet. One of my fellow hospital volunteer escorts, a veteran of the Vietnam war, turned me on to the free classic online episodes of T.V. series The Silent Service, for example the 25-minute 1957 broadcast of

One of my hobbies furthest from a career in music education has to do with collecting and reading books about World War II, particularly U.S. Navy, submarines and surface fleet. One of my fellow hospital volunteer escorts, a veteran of the Vietnam war, turned me on to the free classic online episodes of T.V. series The Silent Service, for example the 25-minute 1957 broadcast of

Powered by artificial intelligence, other voice-activated virtual assistants and knowledge navigators including products like Google Home and Amazon Echo (with a different “girlfriend” named “Alexa”) are flooding the market. This should be no surprise… the 21st Century seems to be developing many new inventions of super-automation, not so far from the female-voiced computer interface on the USS Enterprise (Star Trek) that could control everything. Soon you may take a ride from Uber in a driver-less car or “program” the autopilot on your pure-electric Tesla. Do you foresee the time when you will accept your Amazon merchandise or pizza being delivered from the air? What were those drone-operated lights we saw in the background of Lady Gaga’s halftime performance at the 2017 Super Bowl… possible future special effects for HS musicals and marching band shows?

Powered by artificial intelligence, other voice-activated virtual assistants and knowledge navigators including products like Google Home and Amazon Echo (with a different “girlfriend” named “Alexa”) are flooding the market. This should be no surprise… the 21st Century seems to be developing many new inventions of super-automation, not so far from the female-voiced computer interface on the USS Enterprise (Star Trek) that could control everything. Soon you may take a ride from Uber in a driver-less car or “program” the autopilot on your pure-electric Tesla. Do you foresee the time when you will accept your Amazon merchandise or pizza being delivered from the air? What were those drone-operated lights we saw in the background of Lady Gaga’s halftime performance at the 2017 Super Bowl… possible future special effects for HS musicals and marching band shows?

Reprinted from the Fall 2016 PMEA News, the state journal of the Pennsylvania Music Educators Association

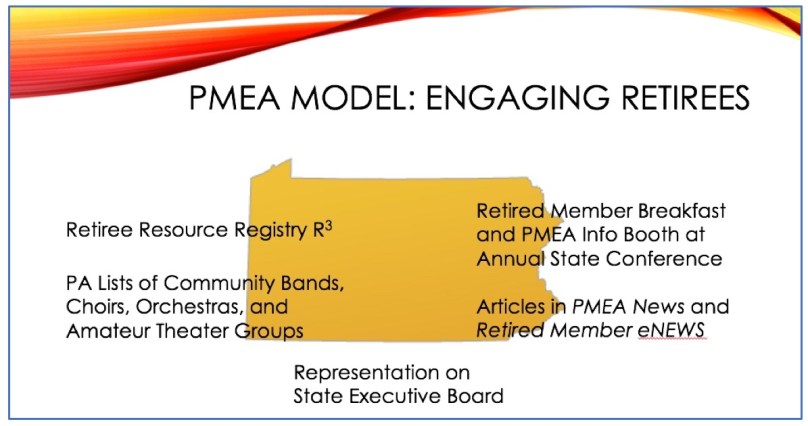

Reprinted from the Fall 2016 PMEA News, the state journal of the Pennsylvania Music Educators Association With the help of PMEA State Director of Member Engagement Joshua Gibson, PMEA retired members researched and compiled a PA community theater directory, to join the listings of bands, orchestras, and choruses posted on the PMEA retired members’ website.

With the help of PMEA State Director of Member Engagement Joshua Gibson, PMEA retired members researched and compiled a PA community theater directory, to join the listings of bands, orchestras, and choruses posted on the PMEA retired members’ website. “Two essentials for successful retirement are sufficient funds to live on and sufficient things to live for. You may have the funds and a list of interests, hobbies, and leisure activities that will keep you busy. Nonetheless, if you want your retirement to be satisfying, these activities may not be enough. You may need an overriding purpose.

“Two essentials for successful retirement are sufficient funds to live on and sufficient things to live for. You may have the funds and a list of interests, hobbies, and leisure activities that will keep you busy. Nonetheless, if you want your retirement to be satisfying, these activities may not be enough. You may need an overriding purpose.

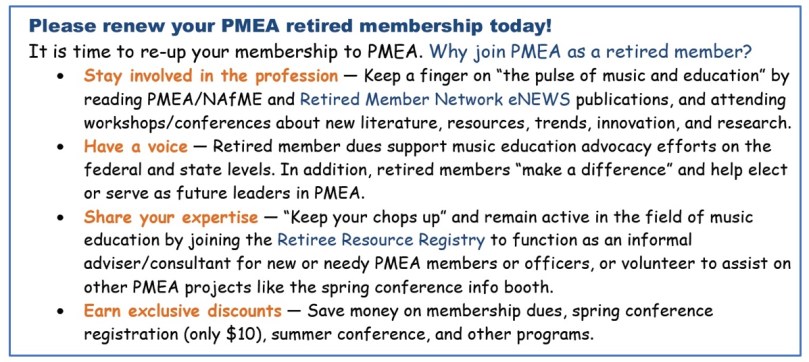

This will sound like an advertisement (it is)… for retaining one’s professionalism, keeping involved albeit less active in the profession, supporting the future of music education, and on occasion lending a hand to PMEA throughout retirement! In return, the association will provide you opportunities to record and post your career accomplishments and position assignments (past and in the future), network with your friends and colleagues retired or still “in the trenches,” and nurture your personal quest for creative self-expression and artistry… everything from guest conducting or adjudicating ensembles to writing for PMEA publications or presenting sessions at the conferences. It is all about YOU!

This will sound like an advertisement (it is)… for retaining one’s professionalism, keeping involved albeit less active in the profession, supporting the future of music education, and on occasion lending a hand to PMEA throughout retirement! In return, the association will provide you opportunities to record and post your career accomplishments and position assignments (past and in the future), network with your friends and colleagues retired or still “in the trenches,” and nurture your personal quest for creative self-expression and artistry… everything from guest conducting or adjudicating ensembles to writing for PMEA publications or presenting sessions at the conferences. It is all about YOU! Research indicates that people either LOVE retirement or HATE it, and their journey to the blessed “golden years” can have many ups and downs, especially for type-A, peak-performing individuals who (used to) spend large amounts of time and personally identified with “the job…” like many music educators. Since retiring myself from the Upper St. Clair School District in June 2013, my goal has been to help others enjoy this life-changing passage, cope with life-style changes/altered expectations, and find creative new ways to self-reinvent and thrive. Objectives for retired members in 2016-18 are:

Research indicates that people either LOVE retirement or HATE it, and their journey to the blessed “golden years” can have many ups and downs, especially for type-A, peak-performing individuals who (used to) spend large amounts of time and personally identified with “the job…” like many music educators. Since retiring myself from the Upper St. Clair School District in June 2013, my goal has been to help others enjoy this life-changing passage, cope with life-style changes/altered expectations, and find creative new ways to self-reinvent and thrive. Objectives for retired members in 2016-18 are:

Are you still willing to “lend a hand” on PMEA projects or share your expertise and provide a free (but priceless) consultant service to new/transferred PMEA members and officers? We constantly update and publish a Retiree Resource Registry

Are you still willing to “lend a hand” on PMEA projects or share your expertise and provide a free (but priceless) consultant service to new/transferred PMEA members and officers? We constantly update and publish a Retiree Resource Registry  In addition, retired member registration at the annual PMEA Spring Conference is… (drum-roll, please!) ONLY $10 early-bird! Our next spring conference will be held on April 19-21, 2018 at the Lancaster Marriott & Convention Center. Music teacher retirees get to enjoy some social time to “swap stories” with a FREE breakfast on Friday, April 20. In addition, we are looking for volunteers to help man the PMEA Info Booth… of course, “retired members to the rescue!” Invitations and more details will go out to current members next month, but check out this section on the PMEA website for more information about the conference:

In addition, retired member registration at the annual PMEA Spring Conference is… (drum-roll, please!) ONLY $10 early-bird! Our next spring conference will be held on April 19-21, 2018 at the Lancaster Marriott & Convention Center. Music teacher retirees get to enjoy some social time to “swap stories” with a FREE breakfast on Friday, April 20. In addition, we are looking for volunteers to help man the PMEA Info Booth… of course, “retired members to the rescue!” Invitations and more details will go out to current members next month, but check out this section on the PMEA website for more information about the conference:  As a part of reflection and sharing of positive strategies for “Crossing the Rubicon” to a happy, healthy, and meaningful retirement, I have assembled a super-site of every website, article, book, publication, etc. of post-employment “gurus” that I could find. Visit the top menu link

As a part of reflection and sharing of positive strategies for “Crossing the Rubicon” to a happy, healthy, and meaningful retirement, I have assembled a super-site of every website, article, book, publication, etc. of post-employment “gurus” that I could find. Visit the top menu link