Editor’s Note: We are happy to post this retirement article by guest author Sierra Powell… concise and solid advice for all current and prospective retirees. Photo credit: https://www.pexels.com/photo/people-on-seashore-1377070/

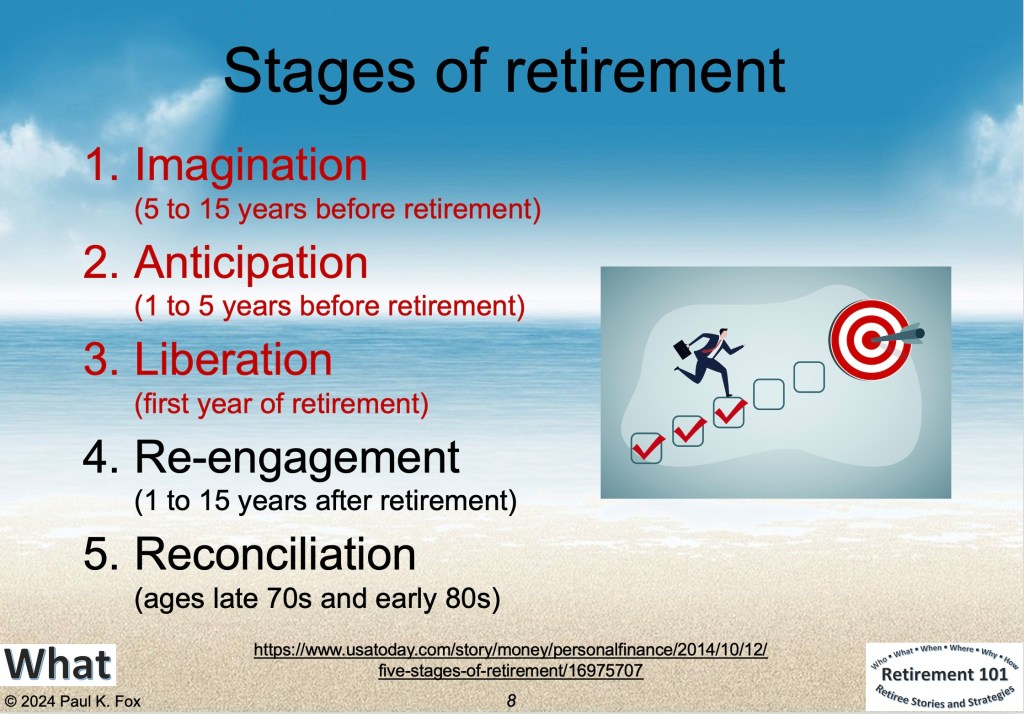

Retirement is a new chapter– An opportunity to savor the results of years of diligence, to follow your interests, and to unwind, free from the demands of 9-to-5 employment. Reaching a comfortable retirement calls for careful decisions supporting your lifestyle and future requirements. Whether you desire to see the world, spend time with loved ones, or just enjoy a slower paced life, several essential components will enable you to have all you need for a safe, happy retirement.

Creating a Comprehensive Financial Plan

A good financial plan is the foundation of a comfortable retirement since it provides a clear road map for handling your money in the next few years. This approach covers forecasting your spending, figuring out revenue sources, and developing a plan for withdrawing money without quickly running out of savings. It goes beyond simple saving. First, project your monthly costs using the lifestyle you want. Add needs such as food, healthcare, and shelter; also include discretionary expenditures for entertainment, vacation, and hobbies. Knowing your planned costs helps you to decide if your revenue sources are adequate to meet them. You can also opt for a good local financial advisor. For example, if you live in Florida, seek a financial advisor in Tampa if you need guidance in selecting the best plan for yourself and your family.

Prioritizing Health and Wellness

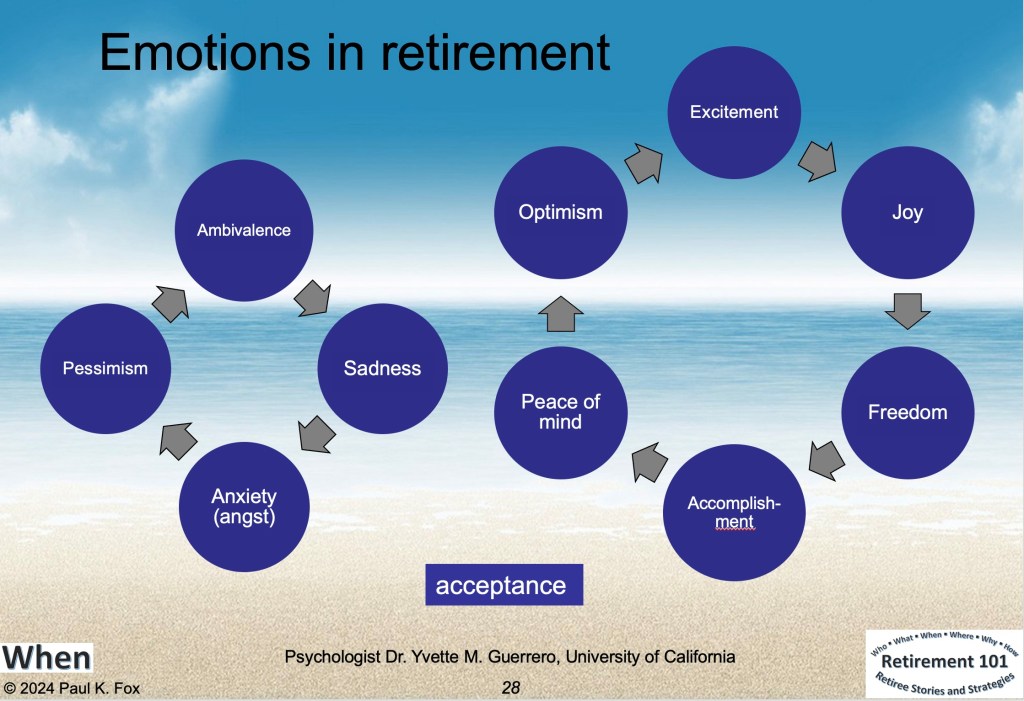

Enjoying a nice retirement depends on keeping excellent health. It becomes difficult to enjoy your newly acquired independence without bodily well-being fully. Emphasize keeping active, following a healthy diet, and planning frequent doctor visits. Time spent in wellness not only improves your mood but also lowers your chance of chronic diseases that could affect your finances or quality of life. Think about adding pursuits that keep your body and mind active. Without taxing your joints too much, low-impact activities like yoga, swimming, or walking provide excellent advantages. Just as crucial is mental stimulation; consider picking up a pastime that tests your brain, acquiring a new skill, or club membership.

Building a Strong Social Network

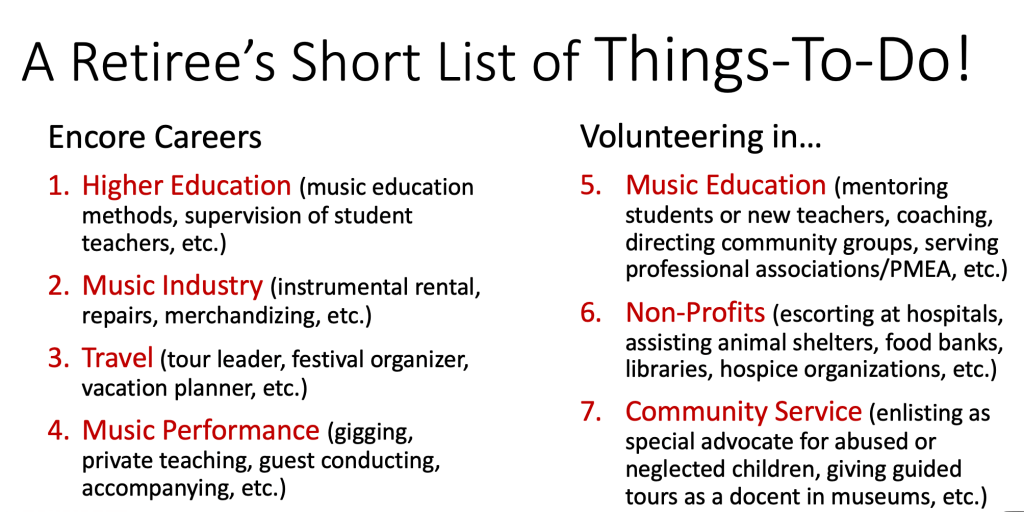

A strong social life improves your retirement experience by offering company, encouragement, and chances to remain active. Retirement typically alters your daily schedule, particularly if most of your prior social life came from employment. By means of actions to establish and preserve a solid network of friends, family, and community ties, you may prevent emotions of isolation and loneliness, therefore influencing both mental and physical health. To meet new people and be active, join clubs, volunteer groups, or neighborhood organizations that fit your interests. To keep your social calendar full, get in touch with old pals, throw events, or schedule visits with loved ones.

Ensuring Housing Stability

Your degree of retirement comfort depends mostly on your choice of living environment. Your house should fit your way of life, be reasonably priced, and call for little upkeep. Downsizing to a smaller house, condo, or senior living complex provides the ideal balance for some between cost and convenience. Smaller spaces cut maintenance, decrease utilities and liberate resources for additional uses. Think about things like family, closeness to hospitals, and services supporting your everyday requirements. If you would like to keep your present house, think about implementing changes that would help keep aging in place. Simple adjustments that improve mobility and safety include adding grab bars in the restroom or substituting ramps for stairs.

Creating a Flexible Budget

Unexpected expenses might develop in retirement even with the finest financial preparation. Creating a flexible budget lets you negotiate these shocks without sacrificing your general financial situation. Set aside some of your savings, especially for unexpected vacation demands, house repairs, or medical bills. An emergency fund serves as a financial cushion so you may handle pressing needs without compromising your monthly income flow. Your budget should also contain a provision for discretionary expenditure for unplanned events such as family visits, holidays, or new interests. This adaptability lets you enjoy the advantages of retirement without feeling limited by your means.

Conclusion

Making decisions according to your beliefs and future vision can help you to create a comfortable retirement. Every component of your retirement plan supports your way of life and well-being, thereby enabling you to savor this new chapter with peace of mind. Accept the chance to live life on your terms, knowing that your careful planning has set a firm foundation for your next years.