How Retirees Can Upsize for Homesteading and Hosting

Featured image via Pexels

[Editor’s Note: My favorite and most prolific “guest blogger” Ed Carter has returned with a piece on upsizing NOT downsizing in retirement. Please enjoy (below) “Bigger Dreams, Bigger Home.” Thanks, Ed!

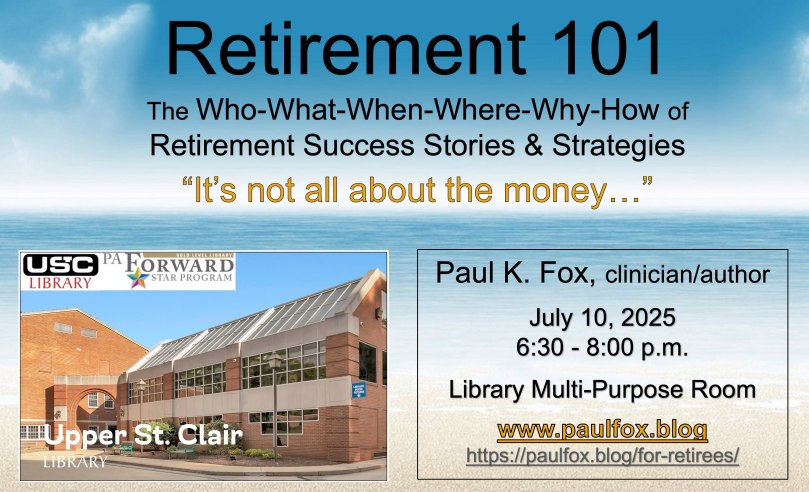

In addition, for attendees to my “Retirement 101 – It’s Not All About the Money” session at the Upper St. Clair Township Library on July 10, 2025 (and any other interested retired or soon-to-retire individuals), please click on the following links to printer-friendly copies of my slide handouts and the updated “Ultimate Retiree Resource Guide.”]

Article by Ed Carter

Retirement doesn’t always mean downsizing. For many retirees, it’s the perfect time to invest in a larger home—one with room to explore new hobbies, welcome visiting family, and enjoy the lifestyle they’ve spent years working toward. If you’re dreaming about homesteading or want to transform your home into a hub of activity and connection, buying a bigger property may be more practical than it sounds. With the right planning, you can find a home that fits your vision and your budget.

Know What You Really Want

Before you start searching, take the time to clarify what matters most to you in this “next chapter.” Are you dreaming of cultivating your own garden, raising chickens, or simply having more space to host grandkids and holiday gatherings? Think about square footage, land size, and features that support your lifestyle, like a home office, workshop, or playroom. Visualizing your daily routines in your new home can help you prioritize what’s essential versus what’s just nice to have.

Focus on Land and Layout

Homesteading takes space—and not just any kind of space. You’ll want to look for properties with usable land that’s suitable for gardening, small livestock, or even fruit trees. Check for sun exposure, drainage, fencing, and access to water. A good layout indoors is just as important; think open kitchens for canning or entertaining, extra rooms for hobbies or guests, and easy access from the house to outdoor areas. A few extra acres can go a long way when your goal is to live more sustainably and independently.

Transform Your Homesteading Hobby Into Income

Many retirees find that homesteading isn’t just fulfilling—it’s also a gateway to a small business. Whether you’re selling fresh eggs, handmade soaps, canned goods, or seasonal vegetables, turning your passion into profit can be deeply rewarding. Going back to school for a business degree can sharpen your skills in marketing, operations, and financial planning—key tools for running your homestead as a business. Online degrees make it easier to balance learning with daily responsibilities, and there are many inspiring online business degree success stories that prove it’s never too late to invest in yourself.

Set a Budget That Reflects Your Goals

Buying a bigger home doesn’t mean blowing through your retirement savings. Start with a clear picture of what you can comfortably spend, keeping in mind property taxes, insurance, maintenance, and any future upgrades. Talk to a financial advisor about how to structure your budget based on your income sources, and consider using proceeds from the sale of a current home if you’re upsizing. You may even find that relocating to a rural or semi-rural area gives you more for your money than staying in a high-cost urban zone.

Explore All the Financing Options

Just because you’re retired doesn’t mean you’re out of options when it comes to financing. Many retirees use a mix of cash, retirement funds, or home equity to buy a new property. Others explore mortgage options like a reverse mortgage (with careful consideration) or traditional loans with manageable terms. It’s essential to speak with a lender who understands your unique income structure post-retirement. The right financing plan ensures you get the home you want without financial stress down the line.

Use a Realtor Who Understands Your Vision

A real estate agent who knows the homesteading lifestyle can help you find properties that truly fit. They’ll understand the value of extra land, zoning laws for small-scale farming, and the features that can make your homestead thrive. Share your vision early in the process—whether it’s selling homegrown produce, raising bees, or hosting family reunions—so they can narrow your options to homes that support both functionality and comfort.

Turn Space Into Opportunity

Once you find your home, think about all the ways to make the most of it. Spare bedrooms can become artist studios or guest rooms for visiting grandchildren. Garages can be converted into workshops or woodworking spaces. Basements can turn into cozy family rooms or even a small business headquarters. Outdoor space can serve multiple purposes: vegetable gardens, orchards, outdoor kitchens, or shaded play areas. With a little imagination, your home becomes a full-time lifestyle—one that supports both your hobbies and your relationships.

Buying a bigger home as a retiree isn’t about having more—it’s about doing more. It’s about designing a life that reflects your passions, supports your independence, and brings your family closer. Whether you want to dig into the soil, start a new business, or simply have space to live fully and comfortably, this move can be the start of something deeply fulfilling. With the right property, the right plan, and the right support, your next chapter can be your most exciting yet.

Peruse more insightful articles and resources here at paulfox.blog, where every post is a step towards a more fulfilling and informed life journey!

PKF

© 2025 Paul K. Fox and Ed Carter