3 by 3: Essential Books + Websites for Music Ed Majors

By now, at least several weeks after the holiday/winter break, most of you have probably returned to school and are “back at it” fulfilling your studies in music and education methods. Welcome to the New Year (2019) and good luck on meeting your goals!

It has been my pleasure to present numerous workshops and conference sessions for pre-service, in-service, and retired music educators on a variety of topics: interviewing for a job, marketing professionalism, ethics, transitioning to retirement, supercharging the musical, etc., and have been asked on occasion, “Where do you find all of the information, research, and resources for your blog-posts and talks?

Well.. I’m glad you asked!

It would be hard to credit one or a few sources on reliable data, insights, and recommendations for career development. The following “gems” – a few ideas from someone who has taught music for more than 40 years – are just my New Year’s “gifts” to you… hopefully useful in your undergraduate or advance degree studies. Please enjoy!

This is probably the wrong time to suggest making a few “buys” for the sake of educational enrichment. College students are bombarded with many required readings of their (often expensive) textbooks and handouts from their comprehensive higher education courses of study. It is somewhat daunting to “cover all the bases,” especially when you may want specific advice and “answers” as a result of being recently thrown into “the real world” of field observations and student teaching. What else would a prospective music teacher need or have time to read? How can we better prepare you for the challenges of our profession?

Since you have to order books (or borrow them from a library), we’ll start with the printed publications. Here are my “top three” for your immediate consideration.

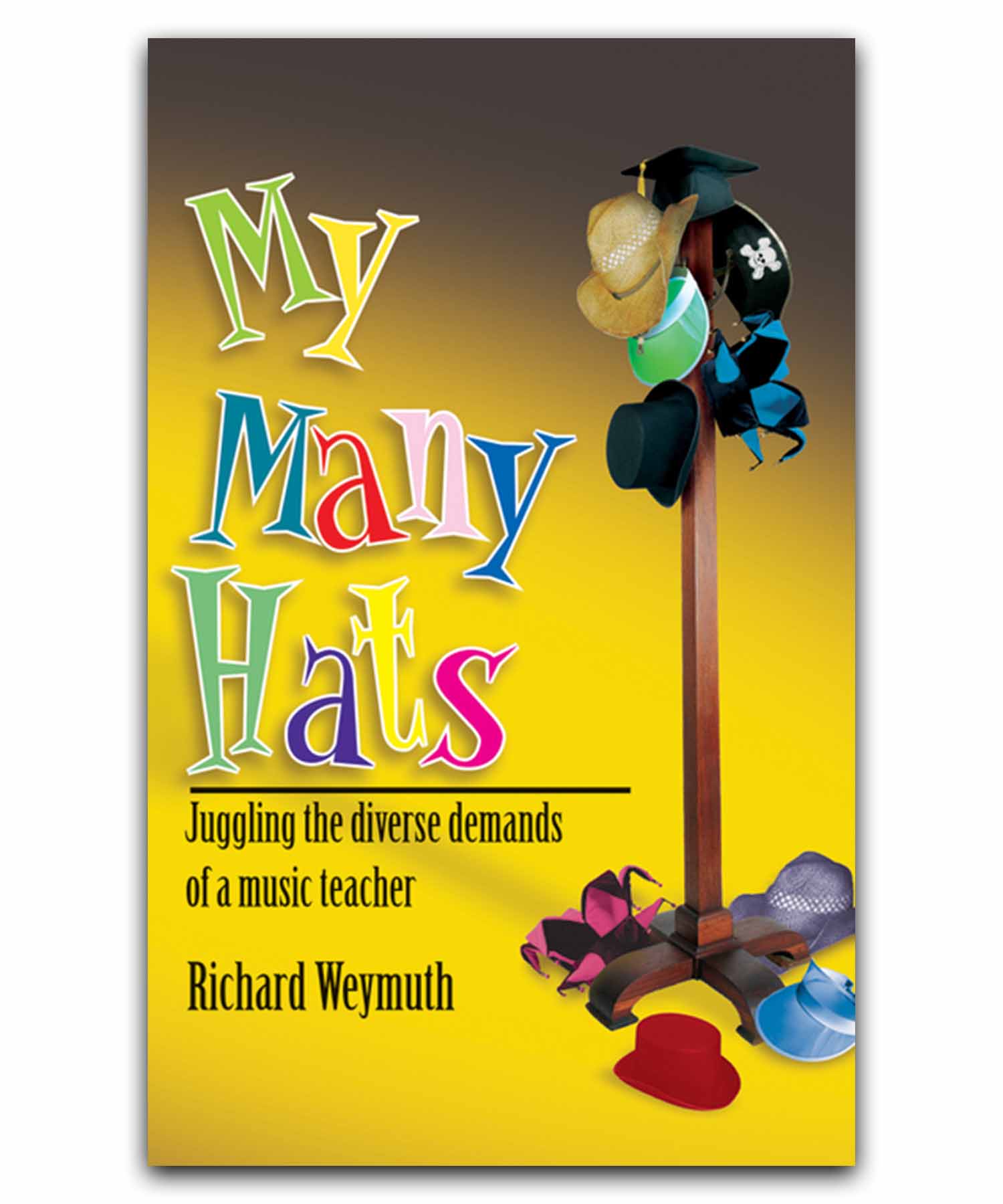

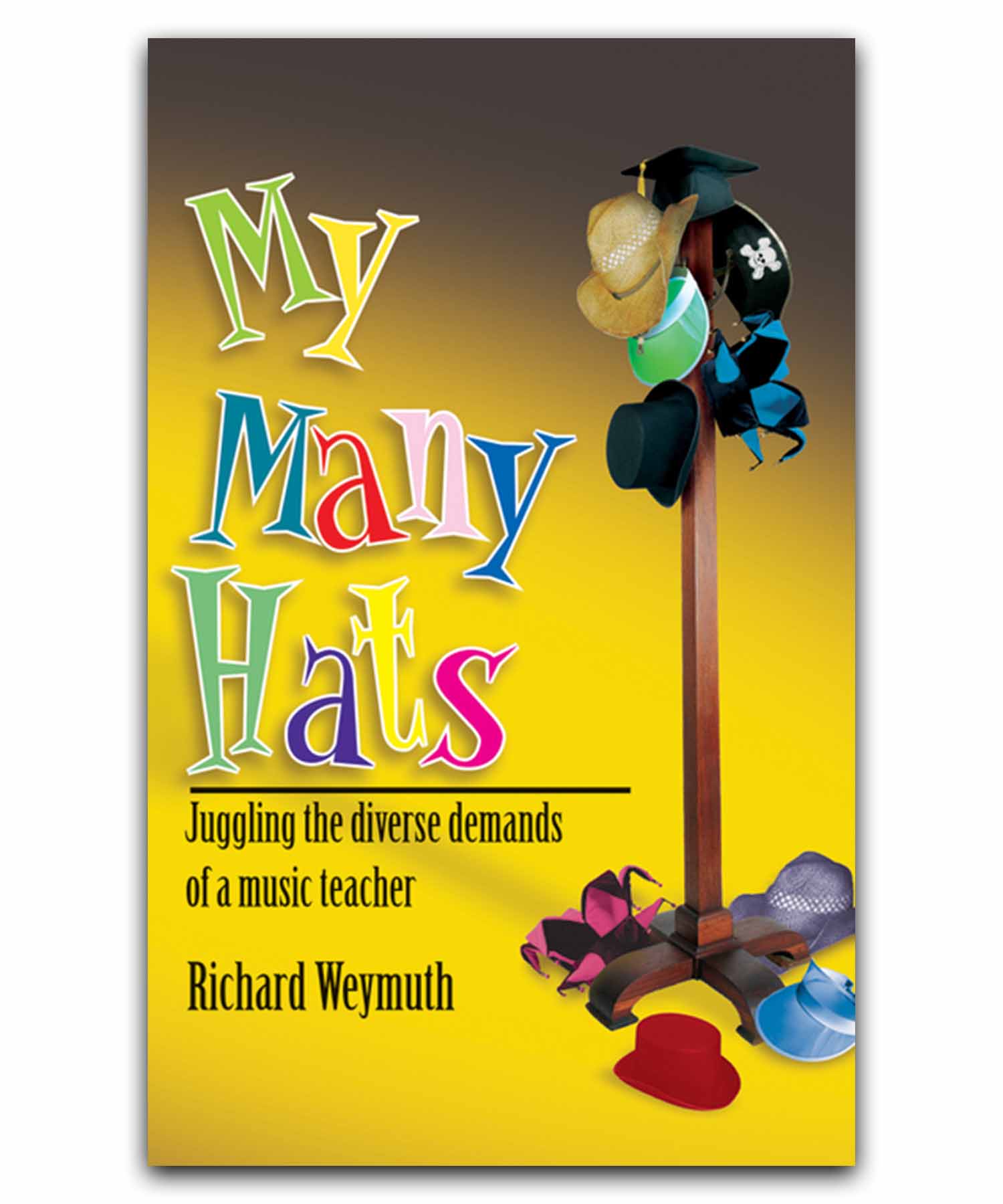

My Many Hats

In the category of “things I wishes someone would have told me before I was hired to be a school music educator,” the inspirational book, My Many Hats: Juggling the Diverse Demands of a Music Teacher by Richard Weymuth, is a recommended “first stop” and easy “quick-read.” Published by Heritage Music Press (2005), the 130-page paperback serves as an excellent summary of the attributes (or “hats”) of a “master music teacher.” Based on the photos in his work (great “props”), I would have loved to have seen Weymuth’s conference presentations in person as he donned each hat symbolizing the necessary skill-set for a successful educator.

In the category of “things I wishes someone would have told me before I was hired to be a school music educator,” the inspirational book, My Many Hats: Juggling the Diverse Demands of a Music Teacher by Richard Weymuth, is a recommended “first stop” and easy “quick-read.” Published by Heritage Music Press (2005), the 130-page paperback serves as an excellent summary of the attributes (or “hats”) of a “master music teacher.” Based on the photos in his work (great “props”), I would have loved to have seen Weymuth’s conference presentations in person as he donned each hat symbolizing the necessary skill-set for a successful educator.

A quote from the author in his Introduction:

“I want my hats to put a smile on your face as you read this book, just as they do for the airport security guards as they go through my bags at the airport. They ask, “Are you a magician? A clown? An entertainer?” My answer is, “Yes, I am a teacher.”

His Table of Contents tells it all:

- The Hat of a Ringmaster: Managing your classroom and your time

- The Hat of a Leader: Setting the direction and tone of your classroom

- The Hat of a Scholar: Learning when “just the facts” are just fine, and when they aren’t

- The Hat of a Disciplinarian: The Three C’s: Caring, Consistency, and Control

- The Hat of an Eagle: Mastering your eagle eye

- The Hat of a Crab: Attitude is everything; what’s yours?

- The Hat of a Juggler: Balancing a complicated and demanding class schedule

- The Hat of a Banker: Fund raising and budgeting

- The Hat of an Artistic Director: Uniforms and musicals and bulletin boards, oh my!

- The Hat of a Lobster: Establishing the proper decorum with your students

- The Hat of a Pirate: Finding a job you will treasure

- The Hat of a Bear: Learning to “grin and bear it” in difficult situations

- The Hat of a Peacock: Having and creating pride in your program

- The Hat of Applause: Rewarding and recognizing yourself

- The Hat of a Flamingo: Sticking out your neck and flapping your wings

Here are a couple sections that should be emphasized if you are currently a junior or senior music education major.

All student or first-year teachers should focus on his/her three C’s of class discipline in Chapter 4: “Caring, Consistency, and Control.” In order to resolve problems and seek advice from local mentors (especially help from second and third-year teachers who may have just gone through similar conflicts), he poses these questions:

- What is the specific discipline problem that is currently bothering you?

- Who could you interview in your educational community to help with this problem?

- How did they handle the problem?

- What discipline solutions worked and what didn’t work?

Those getting ready for the job search and interviewing process this year must turn to Chapter 11 immediately! “Just like a pirate, you are searching for your treasure, or at least a job you will treasure.” Suggesting that first-year teachers should stay in their assignment for a minimum of three years (to show “you are a stable teacher and are dedicated to the district”), Weymuth offers guidance in these areas:

- The Application Process

- The Interview

- Make a Good Impression

- The First-Class Interview

- Frequently Asked Questions

- The Second Interview

The book is worth the $17.95 price alone for the interview questions on pages 85-88.

Once you “land a job” and are assigned extra-curricular duties like directing after-school ensembles, plays, and perhaps fund-raising for trips, shows, uniforms, or instruments, come back to Chapter 8 for “The Hat of a Banker” and Chapter 9 for “The Hat of an Artistic Director.” His guidelines for moneymaking and record-keeping include insightful sub-sections on:

- Planning and Administering a Fund-Raising Activity

- Possible Fund-Raisers

- Motivating Students to Sell, Sell, Sell (Set Goals, Prizes, and Tracking)

- Budgeting

Having previously posted a blog on “Supercharging the School Musical,” I was impressed with his pages 65-69 on “Show and Concert Choir Dress” and The Musical,” and especially the “Appendix – Resources Books for Producing a Musical” in the back of the book.

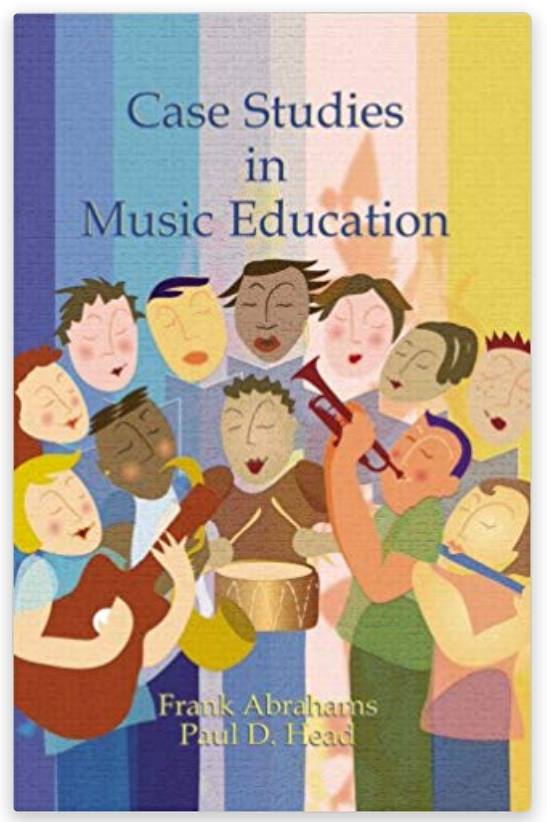

Case Studies in Music Education

Next, I would like to direct pre-service and new music teachers to Case Studies in Music Education by Frank Abrahams and Paul D. Head. This would be an invaluable aid to “facilitate dialogue, problem posing, and problem solving” from college students (in methods classes?) and “rookie” teachers to veteran educators.

Next, I would like to direct pre-service and new music teachers to Case Studies in Music Education by Frank Abrahams and Paul D. Head. This would be an invaluable aid to “facilitate dialogue, problem posing, and problem solving” from college students (in methods classes?) and “rookie” teachers to veteran educators.

Using the format of Introduction, Exposition, Development, Improvisation, and Recapitulation known by all music professionals, each chapter presents a scenario with a moral dilemma that many music educators face in the daily execution of their teaching responsibilities.

“How should a music teacher balance learning and performing? What is the best way to handle an angry parent? What are the consequences of the grades teachers assign? What are the best ways to discipline students? How should teachers relate to the administrators and to other teachers? The emphasis here is not on the solution, but on the process. There are many viable approaches to nearly every obstacle, but before any meaningful long-term solutions can be made, teachers must identify their own personal philosophy of music education and recognize those traits that are admirable in another’s style.”

―Excerpt from back cover of Case Studies in Music Education, Second Edition, by Frank Abrahams and Paul D. Head

Case Studies in Music Education provides a frank discussion about the critical real-world issues music teachers face but are rarely addressed in college courses:

- Balancing the goals of learning and performing music

- Communications and relationships with parents, administrators, and other staff

- “Fair use” and other copyright laws

If you are seeking more reflection and peer review of ethical issues in the music education profession, good for you! Few music teachers ever talk about the “e” word. What’s important is not only becoming aware of your state’s/district’s statues on the “teacher’s code of conduct” and dress/behavior expectations, but developing your own ethical “compass” for all professional decision-making. A good companion to the Abrahams and Head book is to peruse my previous blogs on ETHICS (posted in reverse chronological order).

Enhancing the Professional Practice of Music Teachers

“Book number three” is probably the most expensive, and I could only wish you were already exposed to it in one of your music education courses. If you have not seen it, go ahead and “bite the bullet” in the purchase of Enhancing the Professional Practice of Music Teachers: 101 Tips that Principals Want Music Teachers to Know and Do by Paul G. Young, published by Rowman & Littlefield in 2009. [Note: Be sure to give them your NAfME membership number for a 25% discount!]

“If you want to improve your professional performance and set yourself apart from your colleagues—in any discipline—these tips are for you. If you desire anything less than achieving the very best, you won’t want this book. Rather than addressing research and theory about music education or the “how-to’s” of teaching, Enhancing the Professional Practice of Music Teachers focuses on common-sense qualities and standards of performance that are essential for success-everywhere. Whether you’re considering a career in music education, entering your first year of teaching, or nearing the end of a distinguished tenure, this advice applies to musicians in any setting. Affirming quality performance for experienced teachers and guiding, nurturing, and supporting the novice, Young outlines what great music teachers do. Easy to read and straightforward, read it from beginning to end or focus on tips of interest. Come back time and again for encouragement, ideas, and affirmation of your choice to teach music.”

– https://nafme.org/reading-list-music-educators/

His chapters are organized into six tips:

His chapters are organized into six tips:

- Tips That Establish Effective Practice with Students

- Tips That Support Recruitment

- Tips That Enhance Instruction

- Tips That Enhance the Profession

- Tips for Personal Growth

- Tips for Professional Growth

Paul Young is a musician and band director who later became an elementary school principal. His book is derived from his experience as a music student, music teacher, and educational leader. The intent of the publication is to guide both new and experienced teachers in continued personal and professional growth. He uses his experience as an administrator to point out to music teachers the traits he has seen in individuals who have become successful in the profession.

Now that you ordered at least one of these for personal research and growth, I should point out other sources of book recommendations for the budding music educator, courtesy of NAfME:

Online Resources

Okay, now comes the “easy-peasy” part, and even more importantly, it’s mostly FREE!

The first thing I want you to do (and you don’t even have to be a member of NAfME yet, although you should be!) is to take at least a half-hour, scroll down, and read through numerous NAfME “Music in a Minuet” blog-posts, bookmarking any you want to return to at a later date. Go to https://nafme.org/category/news/music-in-a-minuet/. Get ready to be totally immersed into the music education profession in a way no college professor can do, with articles like the following (just a recent sampling):

The first thing I want you to do (and you don’t even have to be a member of NAfME yet, although you should be!) is to take at least a half-hour, scroll down, and read through numerous NAfME “Music in a Minuet” blog-posts, bookmarking any you want to return to at a later date. Go to https://nafme.org/category/news/music-in-a-minuet/. Get ready to be totally immersed into the music education profession in a way no college professor can do, with articles like the following (just a recent sampling):

Hopefully you did receive a little cash in your Christmas stocking… or something from grandma! Now is time to “belly up to the bar” and pay your dues. Every professional school music educator should be a member of their “national association…” NAfME!

Once you do this, get ready to reap countless benefits! First, besides offering a discounted rate for all collegiate members, you will be eligible for a significant price break for full active membership renewal during your first-year of teaching! Then, the doors will open wide to you for all of the many NAfME member services such as classroom resources, professional development, news and publications, special offers for members, etc.

Once you are a NAfME member, open up your browser, and go immediately to the NAfME AMPLIFY community discussion platform, instructions posted here. Getting started on AMPLIFY is easy:

- Go to community.nafme.org.

- Edit your profile using your NAfME.org member username and personal password.

- Control what information is visible on your profile.

- Join/subscribe to communities of your choice – you will automatically be enrolled in Music Educator Central, our general community for all NAfME Members.

- Control the frequency and format of email notifications from Amplify.

If you prefer, they have created a video or quick-start guide here to set-up your account’s profile, demonstrate the features, and provide some help navigating through the AMPLIFY menus.

Once you familiarize yourself with the forum, find the “Music Educator Central” and “Collegiate” discussion groups… and start reading. If you have a question, post it. AMPLIFY connects you with as many as 60,000 other NAfME members… a powerful resource for networking and finding out “tried and true” techniques, possible solutions to scenarios or problems in the varied settings of school music assignments, and the sharing of news, trends, perspectives, and more!

Try it… you’ll like it! When you feel comfortable with the platform, contribute your own posts, thoughtful responses to comments from the reflections of your “colleagues,” teaching anecdotes, personal pet-peeves, and ??? – you name it! The sky is the limit!

Tooting My Own Horn… the “Paulkfoxusc” Website (now paulfox.blog)

Finally, if you have indeed “blown the budget” over family holiday purchases, I can suggest one freebie website that archives a comprehensive listings of blog-posts, links, and books. Under the category of “marketing professionalism,” you can search through blogs placed online in reverse chronological order at https://paulkfoxusc.wordpress.com/category/marketing-professionalism/ or you can “take everything in” from one super-site entitled “Becoming a Music Educator” at https://paulkfoxusc.wordpress.com/becoming-a-music-educator/.

Of course, I have a few “favorite” articles which may provide you a great start to your journey of self-fulfillment:

Best wishes on you continuing your advancement and personal enrichment towards the realization of a wonderful career in music education!

PKF

© 2019 Paul K. Fox

Photo credits in order from Pixabay.com: “student” by geralt, “book” by PourquoiPas, “girl” by nastya_gepp, “fatigued” by sasint, “learn” by geralt, “brass” by emkanicepic, and “iPad” by fancycrave1

In the category of “things I wishes someone would have told me before I was hired to be a school music educator,” the inspirational book, My Many Hats: Juggling the Diverse Demands of a Music Teacher by Richard Weymuth, is a recommended “first stop” and easy “quick-read.” Published by Heritage Music Press (2005), the 130-page paperback serves as an excellent summary of the attributes (or “hats”) of a “master music teacher.” Based on the photos in his work (great “props”), I would have loved to have seen Weymuth’s conference presentations in person as he donned each hat symbolizing the necessary skill-set for a successful educator.

In the category of “things I wishes someone would have told me before I was hired to be a school music educator,” the inspirational book, My Many Hats: Juggling the Diverse Demands of a Music Teacher by Richard Weymuth, is a recommended “first stop” and easy “quick-read.” Published by Heritage Music Press (2005), the 130-page paperback serves as an excellent summary of the attributes (or “hats”) of a “master music teacher.” Based on the photos in his work (great “props”), I would have loved to have seen Weymuth’s conference presentations in person as he donned each hat symbolizing the necessary skill-set for a successful educator.

Next, I would like to direct pre-service and new music teachers to Case Studies in Music Education by Frank Abrahams and Paul D. Head. This would be an invaluable aid to “facilitate dialogue, problem posing, and problem solving” from college students (in methods classes?) and “rookie” teachers to veteran educators.

Next, I would like to direct pre-service and new music teachers to Case Studies in Music Education by Frank Abrahams and Paul D. Head. This would be an invaluable aid to “facilitate dialogue, problem posing, and problem solving” from college students (in methods classes?) and “rookie” teachers to veteran educators.

His chapters are organized into six tips:

His chapters are organized into six tips: The first thing I want you to do (and you don’t even have to be a member of NAfME yet, although you should be!) is to take at least a half-hour, scroll down, and read through numerous NAfME “Music in a Minuet” blog-posts, bookmarking any you want to return to at a later date. Go to

The first thing I want you to do (and you don’t even have to be a member of NAfME yet, although you should be!) is to take at least a half-hour, scroll down, and read through numerous NAfME “Music in a Minuet” blog-posts, bookmarking any you want to return to at a later date. Go to

PSERS (PA pension fund) Planning: 12 months or more away from your projected retirement date, attend a “Foundations for Your Future” program (even attend it more than once), and request a retirement estimate (form PSRS-151), after which you will need to schedule the all-important “Exit Counseling Session.”

PSERS (PA pension fund) Planning: 12 months or more away from your projected retirement date, attend a “Foundations for Your Future” program (even attend it more than once), and request a retirement estimate (form PSRS-151), after which you will need to schedule the all-important “Exit Counseling Session.”